About

- A regulatory sandbox provides a controlled environment where startups and innovators can conduct live tests of new ideas under the supervision of sector regulators.

We foster innovation through:

- Crowdfunding

- Peer-to-peer lending

Streamlined compliance for success

- Investment-based crowdfunding is a digital method of raising capital in which many individual or institutional investors contribute funds through an online platform in exchange for investment instruments such as shares, debt securities, or other financial interests. It enables businesses particularly start-ups and SMEs to access funding from a broad pool of investors while offering those investors an opportunity to participate in the growth of the business.

- Peer-to-Peer Lending is a form of alternative finance where individuals or businesses borrow money directly from other individuals through an online platform. The platform facilitates the matching of lenders and borrowers, provides risk assessment tools, and manages loan agreements, allowing credit to flow without the involvement of traditional financial intermediaries such as banks.

Applications

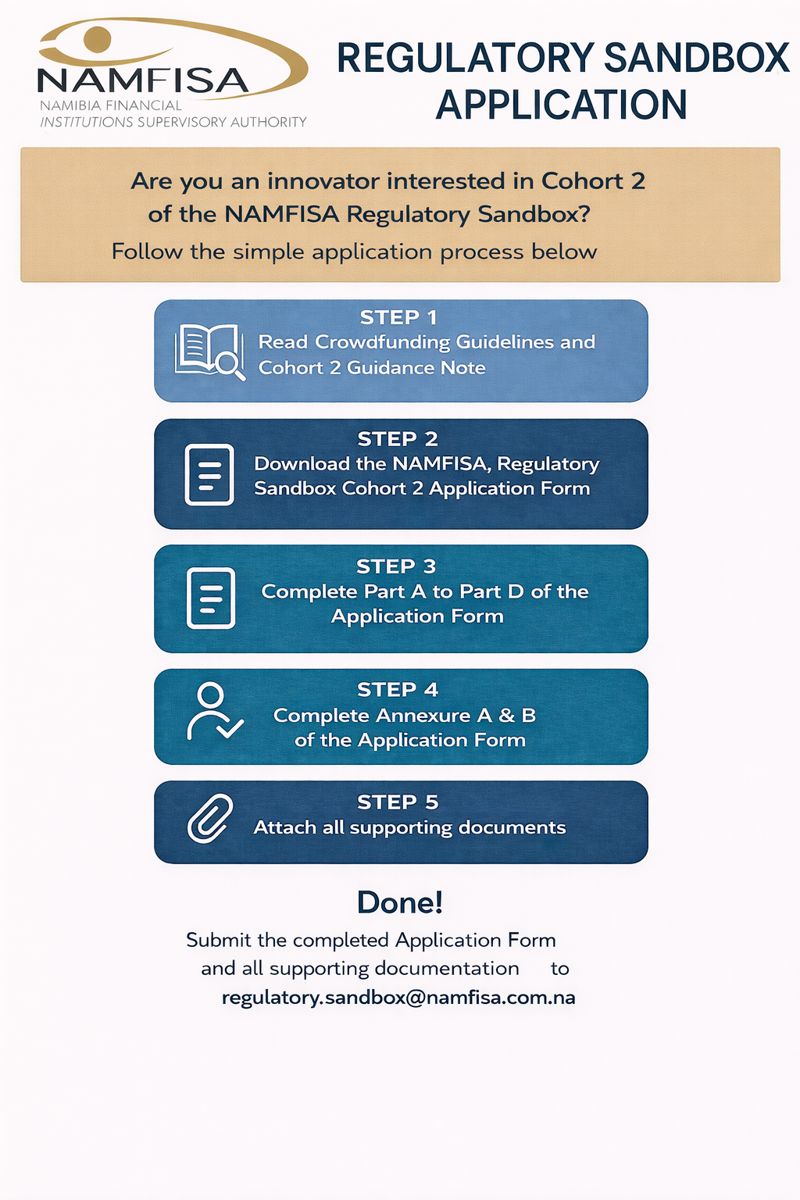

How to Apply

- Access the application form via this link and follow the simple on-screen instructions to duly complete and submit the form: Application Form Deadline for applications: Monday, 23 February 2026

Guidance Notices

How To Apply

- Access the application form via this link and follow the simple on-screen instructions to duly complete and submit the form: Deadline for applications: Friday, 8 March 2024

Contact FinTech Square

fintechsquare@namfisa.com.na

+264 61 290 5008

Frequently Asked Questions

Find answers to your most common queries

What is a Regulatory Sandbox?

- A regulatory sandbox is a tailored environment in which start-up entities and other specified innovators conduct live tests of proposed innovations under controlled conditions while under the supervision of the primary regulator in that sector.

What is the purpose of the NAMFISA Regulatory Sandbox?

-

Regulatory sandboxes can play an important role in fostering innovation that is needed to overcome the barriers to financial inclusion. Therefore, NAMFISA’s Regulatory Sandbox is an evidence-based tool that is established to promote

- digital and non-digital financial services innovation; and

- financial inclusion in the Namibian non-bank financial sector. condonation.

What value does the NAMFISA Regulatory Sandbox add to the Namibian economy and financial services sector?

- NAMFISA’s Regulatory Sandbox is an evidence-based tool that fosters innovation and financial inclusion in the Namibian non-bank financial sector and will ultimately contribute towards national transformative efforts of creating a vibrant, safe and conducive financial sector. In creating this conducive and inclusive environment, more economic opportunities are possible, economic activities have the potential to increase and ultimately, economic growth will be generated through the safe deployment and effective regulation of FinTech solutions in the Namibian non-bank financial market.

Who is eligible to participate in the NAMFISA Regulatory Sandbox?

- Each cohort of the NAMFISA Regulatory Sandbox is specific to a particular industry which NAMFISA regulates, which are Long Term Insurance, Short Term Insurance, Medical Aid Funds, Pension Funds, Capital Market Institutions and Microlenders. Entities may apply to participate in the NAMFISA Regulatory Sandbox if: The entity is already licensed with NAMFISA, but is deploying a new and innovative product, service or solution that achieves the objectives of the Regulatory Sandbox, but may not meet certain requirements under current legislation; The entity is a start-up that wishes to enter the broader market with its innovative product, service or solution, but is inhibited by current legislation; The entity is a start-up with a business model that is new or innovative that achieves the objectives of the Regulatory Sandbox and that is not allowed in the broader market under current legislation; or The entity is requested by NAMFISA to participate in order to test its new and innovative product, service or solution.